Get Savvy Now

Take control of your budget - Effortlessly

SavvyMe helps you track, benchmark and understand your budget.

Say goodbye to clunky spreadsheets and hello to insightful, automated money management.

SavvyMe helps you track, benchmark and understand your budget.

Say goodbye to clunky spreadsheets and hello to insightful, automated money management.

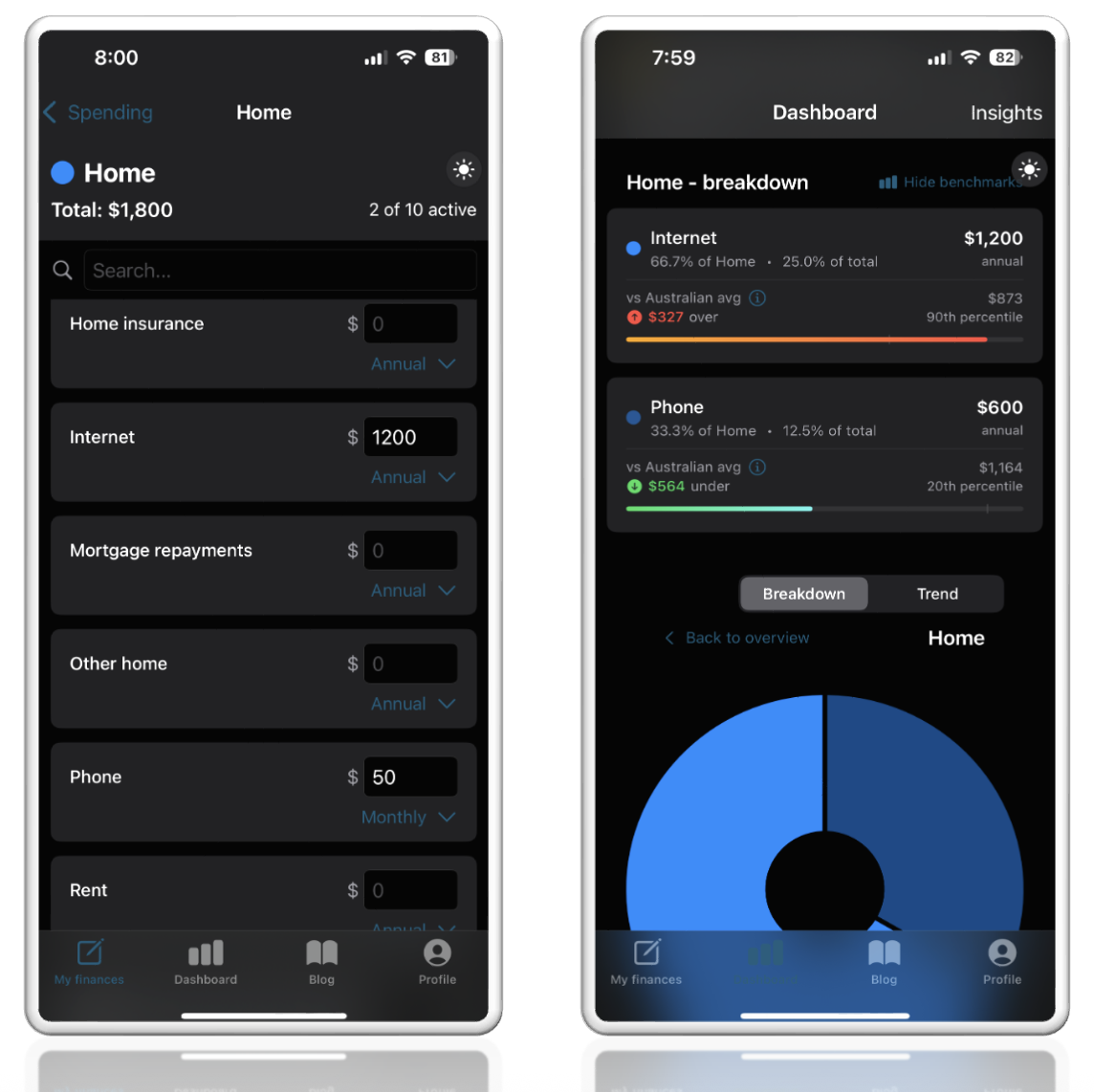

How it works: Enter your spending amounts below and see how you compare to similar households in your area.

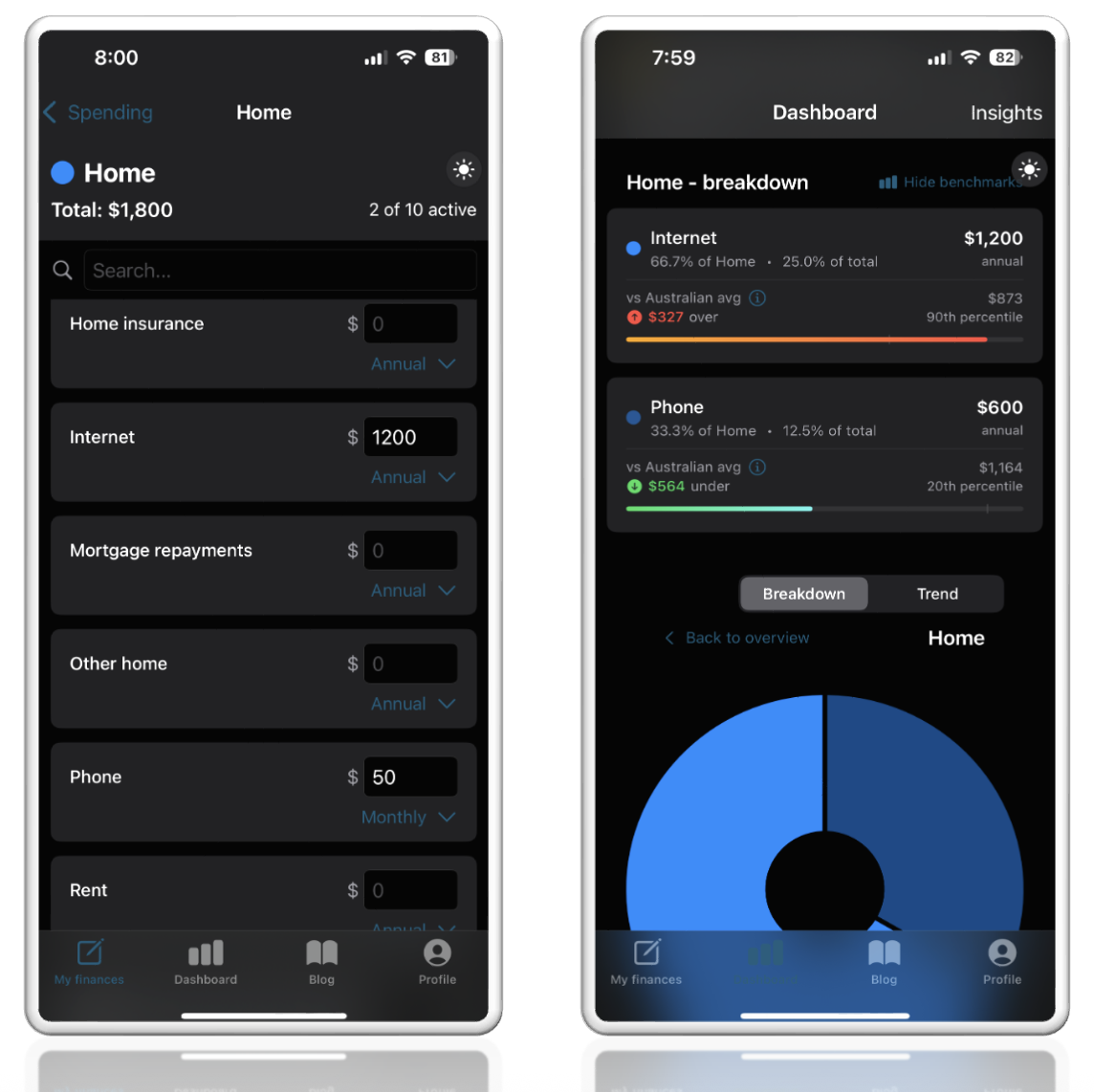

Select specific demographics below for personalised benchmarks

Enter your monthly spending amount for each category

Ditch the spreadsheets and let SavvyMe handle the numbers for you.

Take control of your budget with customisable spending limits. Set and forget - we’ll send you friendly nudges when it’s time to cut back.

Get instant insights and compare your habits to smart benchmarks for a quick financial vibe check.

Set, track, and achieve your financial goals with our built-in goal tracker—because saving should feel as rewarding as spending.

Spend smarter, save better. Get expert saving tips and learn how to get the most out of every dollar.

Get targeted recommendations and deals for areas where you overspend.

Our blog offers helpful insights and money-saving strategies on various topics like budgeting, shopping, entertainment, travel, and more. Start saving now by reading our free tips and hacks!

Want to work with us? Or hear more about what we can do for you?

Please get in touch via the form below!